How to get the most out of consolidating your debt

Consolidating your debt is a smart financial move if you have multiple debts. Debt consolidation offers a number of benefits including convenience, fewer fees, with potentially lower interest and repayments which could lead to great savings.

So how do you ensure your debt consolidation plan gives you all these benefits? We have some tips to help you get the most out of consolidating your debt.

-

Consolidate debt early

Consolidating debt early is the key to getting the most out of a debt consolidation plan. Many people wait until their debts are out of control but consolidating before they become a problem can help you maintain a good credit history and increase the potential savings. The longer you continue paying (or not paying) multiple debts, the more interest and fees you are likely to pay, particularly on credit card debt. When you consolidate debt early, the savings on interest and fees can contribute towards paying off the debt so you can be debt-free sooner. -

Pay more

A debt consolidation plan doesn’t erase debt - it’s simply a more efficient way of managing it and can lessen the interest you pay. To maximise the benefits of debt consolidation you should aim to pay more than the minimum repayments. This can significantly reduce the loan term and dramatically reduce what you pay overall. -

Automatic payments

Debt consolidation is only effective if you actually pay off the debt, so set up automatic payments so you don’t miss a payment. Consistently making repayments on time can help you rebuild your credit score, and ensuring payments happen automatically means you won’t be tempted to spend before you make a repayment. -

Avoid more debt

When you consolidate your existing debt, you should avoid taking on any new debt. If you continue to use credit cards or apply for a personal loan this will negate the benefits that debt consolidation provides. -

Find the best deal

Just like any loan, it always pays to do your research and find the best deal. You can consolidate your debt into a personal loan or with your home loan. Pay close attention to the interest rates as well as the loan terms, fees and any limits on repayments.

Consolidating your debt allows you to combine multiple smaller debts, like a credit card, personal, car or student debt, into one easy-to-manage repayment per month. Combining your other debt into your home loan is a common choice for Australians to take advantage of super-low home loan rates and money-saving features.

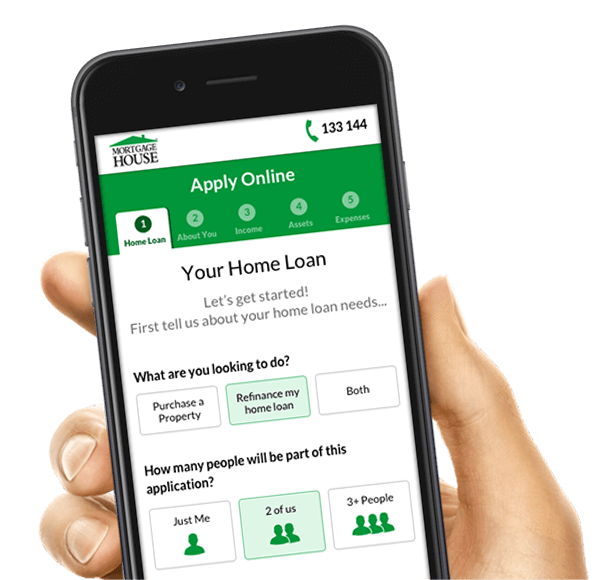

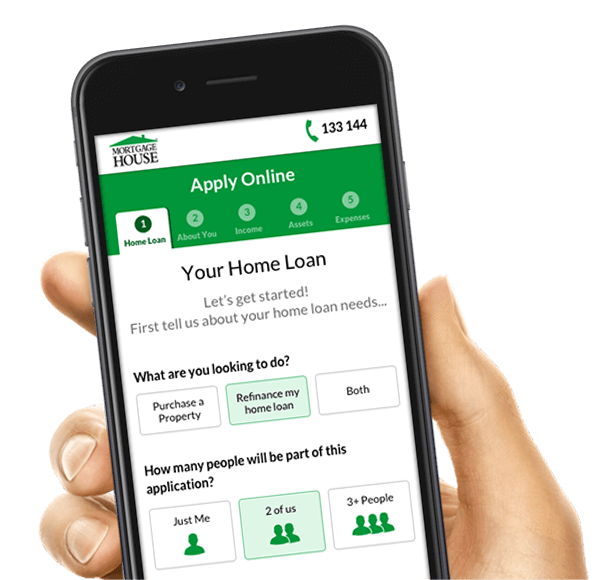

Find out how easy it is to get back on track and manage your debt. Apply online by clicking the button below to begin! Our expert Lending Specialists will find the best solution tailored for you.

Apply Online Anywhere, Anytime.

Less paper work

& waiting time

Complete the

form in 15 minutes

Save and come

back anytime